The impact of COVID-19 on Americans has been intense and will likely be long-lasting. A new, heightened awareness of the dangers of infectious diseases could impact the decisions that we make for years to come. This is especially true in terms of where people choose to reside. For the purposes of this article, I will focus on rental housing options.

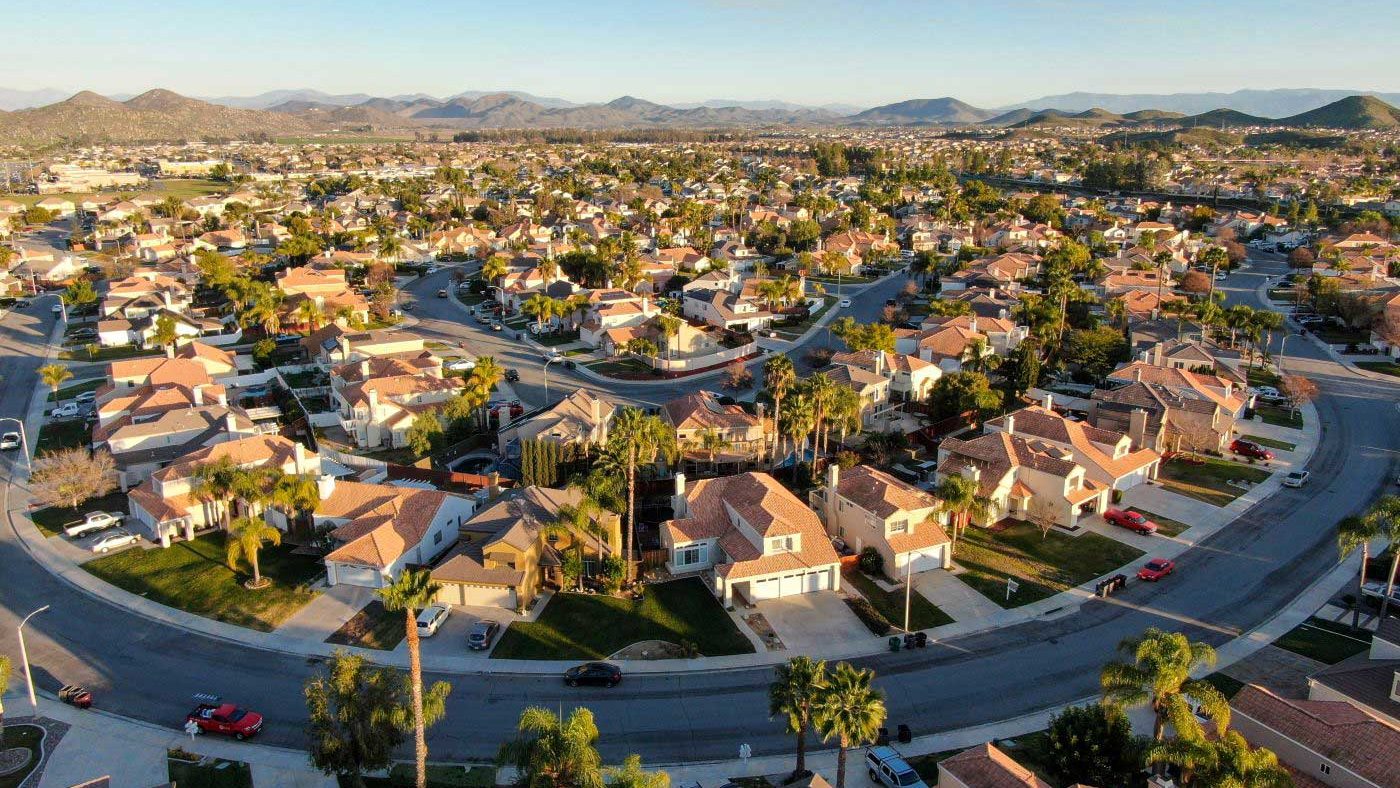

In large metropolitan markets, I foresee a shift in demand away from traditional apartments in urban settings toward build-for-rent (BFR) single-family home communities in the suburbs. The result will be increased development of BFR communities across the country in the upcoming years as investors and developers capitalize on this trend.

The opportunity for developing BFR communities was identified only a few years ago. Following the 2008 recession, institutional investors scooped up and built portfolios of single-family rental homes.

As the economy rebounded, the investors found that existing home price appreciation outpaced achievable rents. A new strategy emerged.

Instead of buying existing homes in a highly competitive market (due to a housing shortage), some investors started building communities of single-family homes to rent.

Over the past five years, there has been a surge in migration toward more affordable metro markets, particularly in the sunbelt region. This has presented an opportunity for capital to flow into BFR communities in markets where there is ample land available for development.

There is a clear commonality between apartment renters and those who choose to rent in BFR communities (as opposed to stand-alone single-family homes). Both groups find value in being a part of a community with access to common amenities, such as neighborhood swimming pools and fitness centers, and most crucially, with maintenance services provided by property management. Master-planned community developers are often willing to sell at a discount to developers of BFR communities because they tend to take great care in their homes’ upkeep.

Three key reasons explain why apartment renters can now find greater value in BFR communities in suburban locations:

- Amenities – Many BFR communities provide amenities that allow for social distancing, such as open space and parks, including pocket parks, dog parks and larger community parks. Walking trails are also common.

- Safety – With detached single-family homes, BFR communities provide a greater sense of personal safety, as opposed to densely populated apartment buildings, where residents have little control of who accesses the building and common areas like shared elevators.

- Space – Single-family homes in BFR communities can also provide residents with more space. This is becoming increasingly important as our homes need to accommodate additional functions, like private offices, gyms, flex space for online schooling, and backyards for families.

As with apartment properties, BFR communities can be segmented according to home product type, unit size, and community services and amenities in order to attract a specific target market. In some regions, where affordability is a primary concern, a BFR community with few (or no) amenity offerings may be the best option.

As an example, Redwood Apartment Neighborhoods, which builds and operates communities in the Midwest, provides maintenance services like snow removal and landscaping, but little else. In other markets, it makes sense to include more community features and amenities like pools, parks, onsite property maintenance, free Wi-Fi, clubhouses, and gated entries.

BB Living’s Higley Park in Gilbert, AZ, for instance, offers a community pool, two-acre park, basketball court, onsite management, splash pad, and playground.

In addition to amenity options, BFR communities can also offer a variety of home product types to attract different segments of the rental market. These include small single-family detached homes, standard homes on traditional lots, and luxury homes on traditional lots.

From a financial perspective, the value of BFR communities is evident. Relative to apartments, BFR communities can see faster lease-up rates, lower turnover and stronger rent growth over time, which is usually sustained even during recessions.

Additionally, cap rates at BFR communities are often somewhat higher than apartments. In master-planned communities, BFR lots can be purchased from developers at a discount when lots are purchased in bulk. Relative to isolated single-family rental properties, BFR communities can also operate at a lower cost through economies of scale, such as with a centralized property management system.

BFR communities offer many appealing opportunities for real estate investors and this will certainly be a field to watch as we consider housing in a post-COVID-19 nation.

Author

Rami Chehabi

Research Consultant

This article was originally published by Xpera Group which is now part of The Vertex Companies, LLC.