I have been accused of reading tea leaves to assist in my forecasting prognostications. Fortunately, the state of the economy is such that by simply using the government’s most mundane data, I can forecast with some degree of certainty the status of the economy through the balance of the year.

The Feds publish a rather dependable series of statistics that often track back 40 or 50 years. Here are a few that I rely on:

Unemployment Claims: When the economy is doing well, the weekly claims are in the 220,000-230,000 range. During the recession, these claims routinely exceeded 650,000 per week. For the past 3-4 years, weekly claims have been dead level at 220,000-230,000.

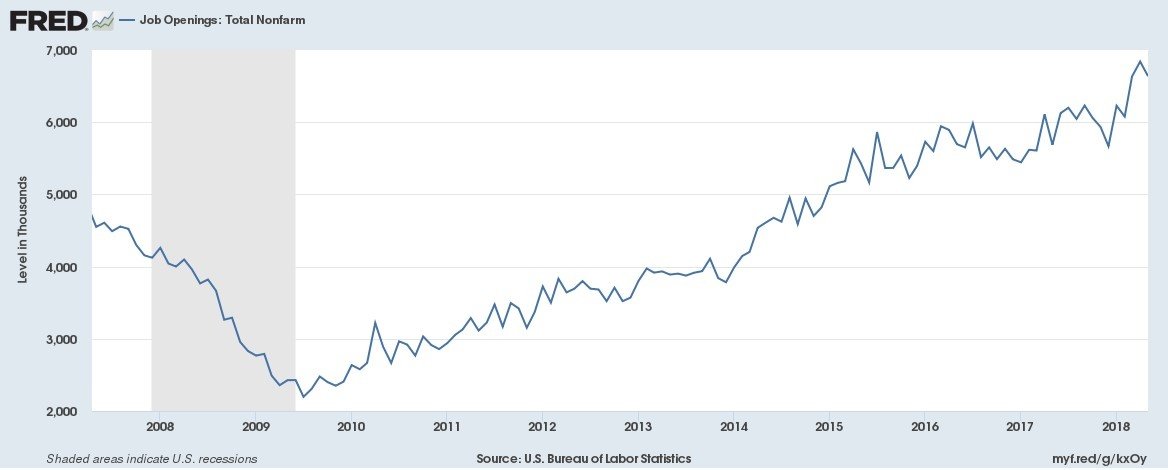

Job Openings: During the recession, job openings were a putrid 3 million. Since the recovery, that figure has accelerated and is now 6.5 million. That portends well for a sense of optimism, but also is indicative of the shortage of qualified labor (See chart on page 2).

Unemployment Rate: This is a fairly reliable statistic on a national basis. Because it is a sample, the smaller the geographic area, the less reliable the statistic is. The current national unemployment rate is in the 3.0% range, perhaps the lowest in more than a quarter century. In some states, it is as low as 2.5%. This means unemployment is effectively zero.

Rate of Inflation: Our nation has been inflationless for the past decade. Now, due to the price of oil and recent tariffs, inflation has moved past the 2.5% level. If we delete oil from the equation, the inflation rate is still in the 2.0% range. Note that the inflation rate does not include a factor for product improvement and the products we buy today are substantially better than the products we bought even a decade ago.

Job Gains: For our nation to continually grow, we need to add more than 2 million jobs annually. Fortunately, we have been meeting or exceeding that level for the past five years.

Population: Most of our nation’s population gains result from natural household formations (more people being born than dying). That pattern is remarkably stable and virtually every year, we add another 2.5 million people to our 50 states. Admittedly, the population distribution is not exactly a level playing field, as California, Texas and Florida account for almost 50% of the total population gains of the U.S. on a long-term basis. Sorry, Detroit.

Car Sales: For the past four years, we have purchased 17 million new cars, a record number to behold.

Interest Rates: The 30-year fixed conforming in SoCal should wind up in the 5.0-5.5% range, unless the Feds really do something stupid.

Housing Market

Now, let’s consider home sales, both new and existing.

On the existing home front, we have been ratcheting up toward the pre-recession number. During the recession, we dropped to 4 million sales. This year, we could reach the 5.5 million level, if there is sufficient inventory.

New home sales figures are very often a function of supply as much as demand. Last year, the U.S. permitted 820,000 new single-family homes and it appears we will top that by 50,000 units this year. On the multi-family side, we are exceeding past years, and, in some metropolitan areas, somewhat exceeding the area’s ability to absorb the burgeoning product. Overbuilding of apartments is rather evident in New York, Washington D.C., Atlanta and Dallas, among other markets. In 2017, there were 462,000 multi-family units permitted and we should match that this year.

Focusing on Southern California (one of the three proposed states bearing the name California), the economy mirrors that of the nation. As Southern California accounts for 1 of every 14 Americans (and most of its creative juices), it is only natural that its economy is a clone of the nation. Actually, with the exception of gas and real estate prices and the volume of litigation, we look pretty much like the other 49 states.

As I look to the last half of 2018 in the six counties of Southern California, I expect our population will maintain its expansion pace. In 2018, Southern California will add 160,000 to the population. As for jobs, the last half of the year will look no different than the first half, adding 100,000+ jobs. We could probably add substantially more jobs, if there were able people to fill them.

Finally, there is housing. It appears that much that my 2018 forecast will come true. (How refreshing.) In 2018, home and apartment builders in Southern California will produce 27,000 single-family homes, the most in the past decade. Vertical builders will continue to produce massive numbers of units, very few of them condominiums. Townhomes, which Census.gov counts as part of the multi-family category, will proliferate, particularly in master-planned communities. Total multi-family units produced in Southern California in 2018 will total 28,000, maybe even more.

On balance, with or without my tea leaves, I will maintain my opinion that the second half of 2018 will be a clone of the first half and the nation and Southern California will continue to prosper. The real question is: “What will happen in 2019?” Stay tuned.

This article was originally published by Xpera Group which is now part of The Vertex Companies, LLC.